Beefy DAO manages the protocol but operates independently, encompassing contributors and Neighborhood users. Although it maintains the protocol, the DAO can not Get well funds missing in immutable wise contracts, highlighting the separation amongst DAO Handle and protocol functions.

The protocol’s Main is constructed around Dwell Vaults and involved wise contracts that manage person deposits, execute automatic generate farming processes, and distribute attained rewards.

These traits produce many generate prospects over the ecosystem safely, decentralized by easy interfaces. Beefy is often a DeFi Produce Optimizer that can help buyers gain much more copyright belongings by means of automobile-compounding, leveraging these decentralized attributes To optimize returns.

Beefy Finance: beefy.finance Beefy Finance is often a decentralized and multi-chain fiscal System that is certainly blockchain agnostic. It is additionally a generate optimizer that allows users to earn compound fascination on their own token holdings. It takes your yield earnings and reinvests them to spice up your gains.

Certik has audited many of the most elaborate and reusable expense procedures used within the System. This assures the safety and sturdiness of important intelligent deal factors that almost all of our buyers communicate with.

Collectively, these protection steps type a strong defense procedure that secures Beefy Finance's System and its buyers' investments versus a big range of threats.

In summary, Beefy Finance leverages blockchain technologies to provide a decentralized System for produce optimization. Through its Vaults and $BIFI token, it provides an extensive solution for consumers on the lookout to maximize their copyright earnings even though contributing to your governance and achievements on the platform.

It optimizes yields utilizing the vault procedure. The platform employs various intelligent deal developers who take a look at and approve vaults, new good contracts, and investing approaches before releasing them to the public.

A yield optimizer is an automatic provider that seeks to realize the utmost doable return on copyright-investments, a lot more successfully than seeking to increase yield by manual suggests.

When consumers look through vaults within the Beefy platform, they begin to see the once-a-year share produce (APY), which accounts for Repeated compounding, plus the day-to-day curiosity percentages and the total worth locked (TVL) in each vault. The vaults are categorized based upon the underlying platform they use to produce revenue, whether by liquidity pools or one-stake reward swimming pools.

Beefy Finance employs a multifaceted method of ensure the safety of its System and safeguard customers' copyright investments.

Notably, this automation minimizes transaction costs and enhances data integrity, making Beefy Finance a key player during the decentralized finance Area. Around the Beefy System, a few sorts of vaults can be obtained:

An anonymous team of individuals Launched Beefy Finance. The beefy fi staff believes which the venture speaks for alone and that delivering the best possible practical experience for its customers is a lot more important than displaying personalities.

Just about every strategy is exclusive and undergoes thorough screening in advance of deployment. They're made to answer extrinsic hazards, with functionalities to withdraw cash safely and securely or halt operations if essential. By automating elaborate processes, Beefy methods preserve consumers time and transaction charges whilst maximizing returns from liquidity pools and lending platforms.

Alexa Vega Then & Now!

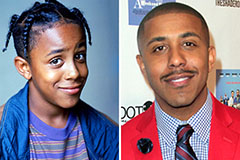

Alexa Vega Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!